Choosing the right business entity can be tricky, but understanding what an LLC is can help you make the best choice.

- LLC stands for limited liability company; LLCs protect a business owner’s personal assets if they’re involved in a lawsuit.

- An LLC can be taxed as a sole proprietorship, an S corporation or a partnership.

- An LLC can have unlimited members, unlike an S-corp, which is limited to 100 shareholders.

- This article is for entrepreneurs who want to know if an LLC is the right structure for their new business.

A limited liability company (LLC) is a popular option when a startup chooses a business legal structure. An LLC is flexible, giving you taxation options and flexibility in the number of owners allowed. However, an LLC’s most compelling quality is its ability to limit personal liability if your business is sued or files for bankruptcy. Read on to learn more about this business structure, its benefits and disadvantages, and how to start one.

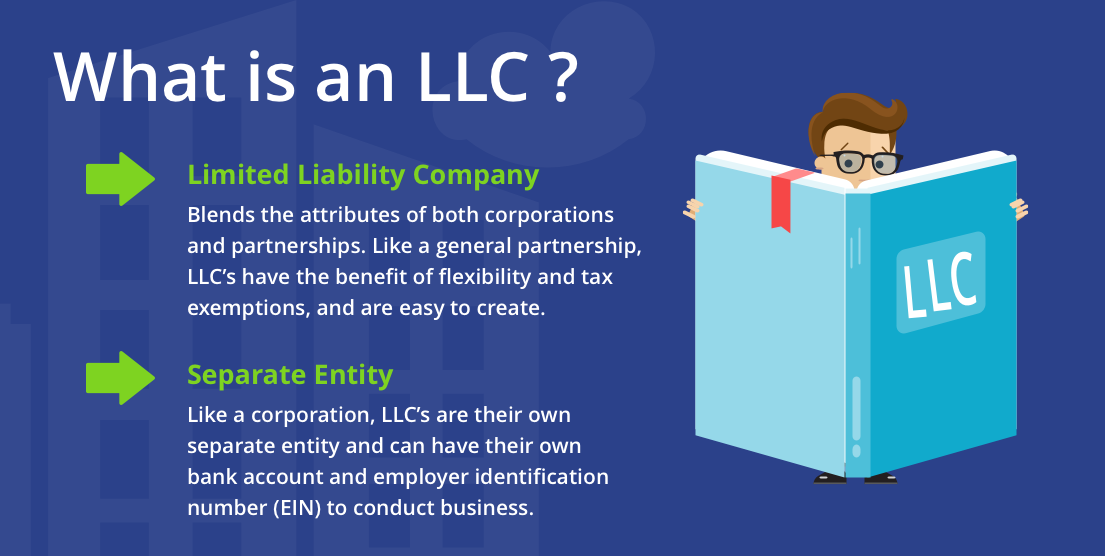

What is an LLC?

An LLC is a hybrid legal entity with the characteristics of a corporation, partnership and sole proprietorship.

“LLCs are just another entity type to protect the business owners,” said attorney Ryan Gordon.

Typically, LLCs are highly advantageous for business owners. They provide the same liability protection as corporations without requiring board meetings, corporate recordkeeping, or other tedious paperwork and events.

A business of any size can be an LLC, further adding to their flexibility. An LLC is a popular and flexible business legal structure, especially for small companies and startups.

Key takeaway: An LLC is a business entity that helps shield a business owner’s personal assets from business debts or if the business faces a lawsuit.

What are the benefits of an LLC?

An LLC offers several benefits for businesses and owners, including the following:

- It protects owners’ assets. An LLC’s most significant benefit is protecting its owners’ personal assets if the business faces legal issues. Suppose your business is hit with a lawsuit. If your business is structured as an LLC, your assets are protected from any judgments imposed on the business. If your business can’t afford to pay the judgment, you, as a business owner, won’t be forced to pay the money from your personal finances.

- It offers management flexibility. Another crucial benefit is flexibility in how the business’s management team is structured. An LLC can either be member-managed, meaning owners handle day-to-day responsibilities, or manager-managed, meaning the owners bring in someone from the outside to handle the daily aspects of running the business. An LLC doesn’t limit how many owners a business can have; it allows you to see how profits are divided among the owners based on the operating agreement. “The LLC’s operating agreement provides the framework for how the company will be run, the relationships between the managers and members of the company, the plan for allocating profits, and other critical information pertaining to the operations of the LLC,” said Paolo De Jesus Jr., co-managing partner at Romano Law.

- It doesn’t require much paperwork. Also, if you’re not a big fan of paperwork, an LLC is worth considering because it requires much less documentation and administrative procedures than other business structures.

What are the disadvantages of an LLC?

The disadvantages of an LLC are minor compared to its benefits. If you own your business alone, forming an LLC can sometimes be more costly than maintaining sole proprietor status. You may need to pay annual reporting and franchise tax fees that wouldn’t apply with a sole proprietorship. And if your LLC is a partnership, transferring ownership shares might take more work than with an S corporation or C corporation.

Of course, you can avoid the latter problem if you register your LLC as an S corporation or C corporation. Doing so comes with the disadvantage of filing even more paperwork, though depending on your financial situation, this transition may lower your taxes. That could make the extra paperwork well worth your while.

How are LLCs taxed?

The federal government references LLCs as a “disregarded entity.” When you choose this particular business structure, the IRS taxes you as a sole proprietorship (if you’re a single-member LLC), a partnership (if you have more than one member) or a corporation (either as an S corporation or a C corporation, if that’s what you elect). Once this selection is made, the business calculates taxes based on those tax rules for the IRS and then prepares an LLC return for the state where they do business.

The benefit of this taxation structure is that LLCs are not subject to separate federal taxes unless the LLC is a C-corp. This is because the LLC’s profits and losses are passed to each owner, who then submits that info with their personal income tax return. This “flow-through” structure avoids the double taxation that corporations experience where the business pays taxes on profits, which are then taxed again when the business owner pays personal income tax.

However, business owners must pay self-employment taxes and may find themselves in a higher tax bracket. In such instances, they may be able to save money by electing to be taxed as an S-corp.

“It is actually possible for an LLC to also be an S-corp for the purposes of taxation,” Gordon said. “LLCs may also be taxed as partnerships, and partnership taxation is actually the default classification of an LLC for tax purposes.”

Tip: Payroll software can ensure that your LLC pays the right tax amounts. Visit our reviews of the best payroll software to evaluate your options. Start with our in-depth OnPay review – our top choice for very small businesses.

What is the difference between an LLC, S-corp and partnership?

When choosing their legal structure, many new business owners ask, “What’s the difference between an LLC, an S corporation and a partnership?”

First, let’s address the common root of confusion, which usually comes from using these terms to discuss a legal entity’s structure when you’re actually talking about how it’s taxed. An S-corp is a tax classification.

“There is no such thing as ‘LLC tax,’” said Heather Harmon Kennedy, owner of Harmon Kennedy Law. “So even though you may have an LLC as your entity structure, you might be taxed as a sole proprietor, partnership, S-corp or C-corp.”

If your LLC consists of only you – one member – the IRS treats the LLC as a sole proprietorship. However, the LLC will be taxed as a partnership if you have multiple members. Then, depending on your specific tax situation, you may elect to tax the LLC as an S-corp.

With an S-corp, business owners may reduce their personal tax burden, as the business pays them a salary and covers their payroll taxes, which means they do not pay self-employment taxes. But S-corps have some additional restrictions. For instance, non-U.S. citizens cannot be owners in an S-corp, but they can in LLCs.

An LLC is more flexible and generally less restrictive than an S-corp, according to prominent trademark lawyer Xavier Morales. “For example, an LLC can have unlimited members, while an S-corp can have no more than 100 shareholders or owners,” said Morales.

Tip: If you’re wondering whether to set up your business as an LLC or S Corporation, you’ll need to consider the taxation and management structure ramifications and decide which is best for your organization.

Do LLC laws vary by state?

Many states restrict the business types that can be formed via LLC. For instance, many states prohibit businesses in the financial services industry from forming an LLC.

Susan Henderson, senior tax manager with California-based Hudson Henderson and Company Inc., said that there are tax matters to consider, particularly with the variance in different state tax laws.

“For some businesses, an LLC makes sense, as it allows for the operation of a business with lots of investors and, potentially, the flexibility to distribute income however they deem appropriate from a year-to-year basis – assuming they have adopted the partnership tax treatment for the IRS,” said Henderson. “This flexibility could also include deciphering which members should pay Social Security tax on income and who doesn’t. However, state laws vary greatly regarding LLCs, so you need to be aware of the tax situation specific to your state to determine if this is to your advantage.”

How do you start an LLC?

For business owners looking to go the LLC route, here’s what you need to do to get set up. Remember, the requirements vary based on your state, but the following are general rules that apply wherever you’re located.

1. Choose an available name for your business.

When choosing a business name, you won’t be allowed to use a name that’s already been taken; several states offer a way to determine if the name you want is still available. Notably, if your public-facing business name differs from the LLC name the government sees, you must register a “doing business as” (DBA) name.

“It is important to be original and unique when choosing a name in order to avoid confusion and potential trademark infringement claims,” said De Jesus. “If you have chosen a name that is available, but you are not yet ready to file the LLC documents, you may want to reserve the name you have chosen to ensure it is not taken before you file. The length of the reservation period will vary from state to state.”

2. Choose a registered agent.

A registered agent is an individual or company in the state you’re filing that receives your official documents on behalf of your LLC. A registered agent is basically a go-between who passes information along to you. This is a requirement in most states.

3. Prepare the LLC operating agreement.

Even though this may not be required in some states, De Jesus suggests drafting one anyway because it’s important to have an outline of how your LLC will run.

The operating agreement includes following details:

- Business organization

- Board of managers

- Voting requirements

- Restrictions on transferring and selling shares

- Division of company profits and losses

- Dissolution of the company, if needed

4. File articles of organization with the state.

An LLC is formed by filing articles of organization with the secretary of state’s office. To fill out this form, you will need your LLC’s name, address and purpose. Depending on the state, the filing fee varies, and the articles of organization may be referred to by a different name, like the certificate of formation. You can hire a local accountancy firm or attorney for help with forming your LLC.

Did you know?: If you were forming a corporation, you’d file an operating agreement and articles of incorporation.

LLCs are often the right choice

An LLC is a relatively easy classification to obtain, and it can be a huge help if your business ever faces a lawsuit. It can also impact your taxes positively depending on how, or if, you choose to pursue federal corporate status. Look up the LLC laws in your state, seek expert help and, before you know it, you’ll have the legal protection every business needs.

Read & Write : write for us

Lifeyet News Lifeyet News

Lifeyet News Lifeyet News